FAFSA Simplification

FAFSA Simplification Act – What you Need to Know

Changes are coming to the Free Application for Federal Student Aid (FAFSA) for the 2024/2025 aid year! The Financial Aid Office will update this page as additional information is made available.

Changes are coming to the Free Application for Federal Student Aid (FAFSA) for the 2024/2025 aid year! The Financial Aid Office will update this page as additional information is made available.

The FAFSA just got shorter – it will go from 100 questions down to 36.

Change takes time, so the 2024/2025 FAFSA will open by the end of December 2023, not on October 1 as in the past. Here are a few things you need to know in the meantime.

Why Did the FAFSA Change?

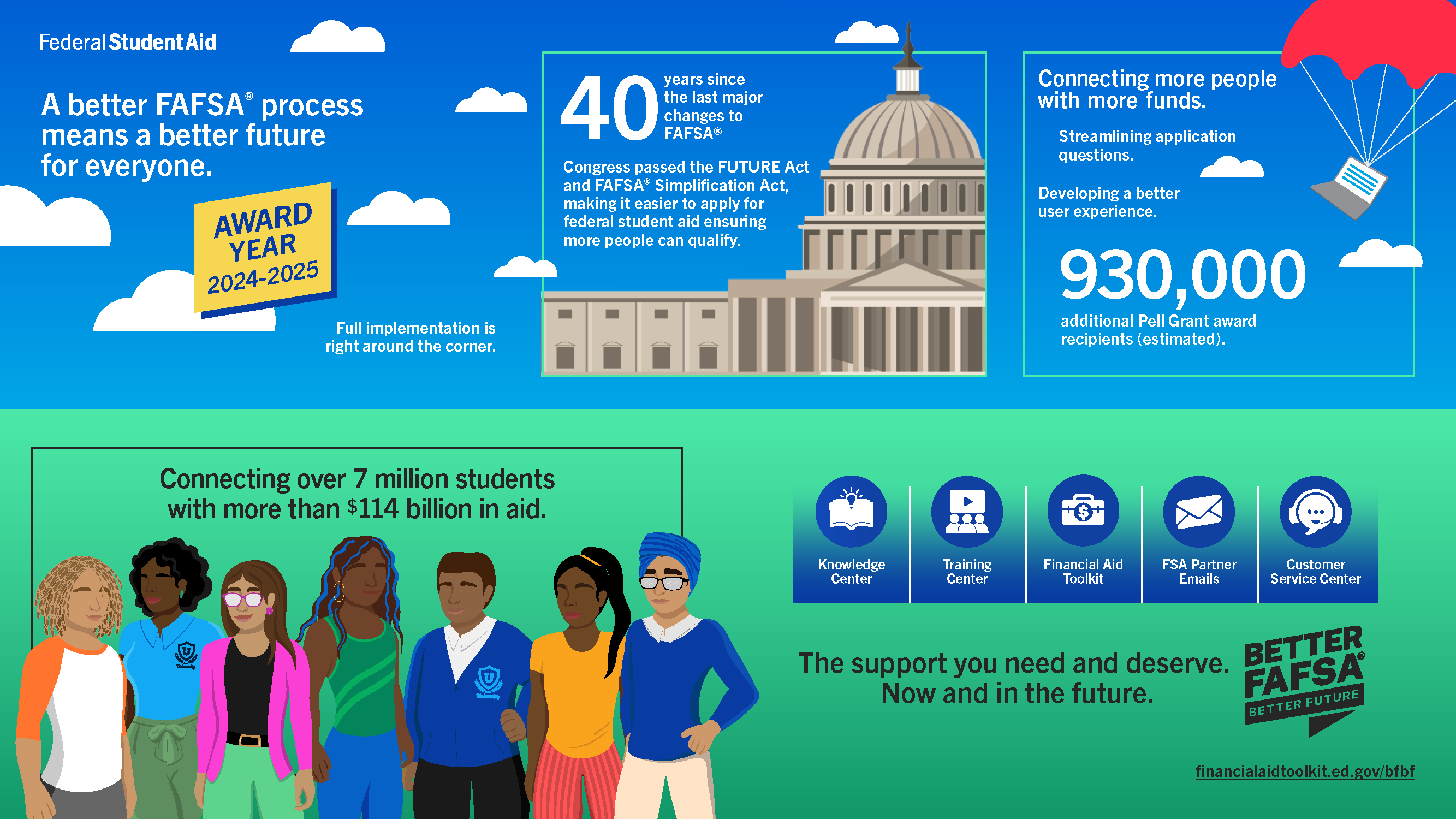

The new laws make it easier for students and families to complete and submit the FAFSA form and expands access to federal student aid – Pell grant, Direct Student Loans, Supplemental Educational Opportunity Grant, and Federal Work Study.

This is the first major update to the FAFSA in over 40 years - - it was time.

What’s Changing?

- Streamlined Application – there will be fewer questions and an easier way to transfer tax information directly from the IRS.

- EFC (expected family contribution) is changing to SAI (Student Aid Index) – this is the new need analysis formula for determining federal aid eligibility.

- New Terminology – a Contributor is anyone who is asked to provide information on the FAFSA, a parent or a student’s spouse, for example. Consent is required from each contributor to have their information included on the FASFSA.

- Security has improved - - multi-factor authentication will be used to log into the FAFSA, much like your bank, you will verify your identity at sign in.

What’s Not Changing?

- Students still need an FSA-ID – create one if you don’t have one or you will use the one you already have.

- All Contributors still need an FSA-ID – create one if you don’t have one or you will use the one you already have.

- Prior, Prior Tax information is still used, so for the 2024/2025 FAFSA, the 2022 tax return will be linked to the FAFSA.

Special and/or Unusual Circumstances

The FAFSA Simplification Act allows financial aid administrators added flexibility to make adjustments to a student’s FASFA based on a student and/or family’s financial circumstances. This process is known as a professional judgement and can extend to declared disasters, emergencies, or economic downturns.

2024/2025 FAFSA Student Enrollment Intensity & Pell Eligibility

Assuming a Full Pell Grant is $7396 ($3,698 per semester)

| Credit Hours Enrolled | Enrollment Intensity | Dollar Amount |

|---|---|---|

| 12 (Or More) | 100% | $3698 |

| 11 | 92% | $3402 |

| 10 | 83% | $3069 |

| 9 | 75% | $2774 |

| 8 | 67% | $2477 |

| 7 | 58% | $2144 |

| 6 | 50% | $1849 |

| 5 | 42% | $1553 |

| 4 | 33% | $1220 |

| 3 | 25% | $925 |

| 2 | 17% | $629 |

| 1 | 8% | $296 |

Resources

LEARN MORE